As of April 1st 2019, more than ten of the world’s leading finance institutions and banks announced a combined effort to develop the multi-trillion dollar market that is trade finance, as an asset class of its own.

This means institutional investors that would normally operate in other areas of investing, may well invest heavily in the area of trade finance – one of the most dependable drivers of revenue for many of the top tier banks.

- ANZ Australia and New Zealand Banking Group

- Commercial International Bank (Egyptian)

- Deutche Bank

- HSBC

- ING

- Lloyds Bank

- Rabobank

- Standard Bank

- Standard Chartered Bank

- Sumitomo Mitsui Banking Corporation

- The International Chamber of Commerce (ICC)

- The International Trade and Forfaiting

Association (ITFA)

Above is a list of the ten major banks – alongside other

observing bodies and asset managers – that have agreed to launch the drive

behind this initiative, which is believed to focus on creating common data

standards and definitions that enhance trading and production efficiency.

Furthermore, the TFD initiative is also aimed at the improvement of risk

management which will sustain a blueprint for global trade

finance asset distribution.

There are many reasons behind the initiative being a

profitable venture for many areas of the world’s finance market. The first one

is that trade finance is currently an area of banking that is worth over $12

trillion dollars globally per year, and it is still growing.

As more emerging markets grow their international trading

capabilities, so does the market for trade finance. But it is not only the

underdevelopment of global participation that is what has attracted enough

attention to create the TFD, but also the lack of advanced technology involved

in the area of banking.

The

Initiative Explained

The basic concept behind this, is a single platform that

uses smart technology to link the gap between trade suppliers and the providers

of liquidity that assists trading levels all around the globe.

Surath Sengupta, the Global Head of Trade Portfolio

Management for HSBC spoke on the initiative “while trade finance is currently

an attractive asset class for banks, we believe technology will unlock

investment from non-bank investors by removing complexity and making the

underlying asset data both more structured and accessible”. This essentially

then makes the product (trade finance assets) more readily available to a wider

audience, which will create further demand – hopefully promoting more global

trade.

The benefits of having standardised rules around the globe

with regards to trade have been displayed many a time. A good example would be

the Incoterms

so many trading firms rely on all around the globe. By developing new

solutions, using up-to-date technology to package the many portfolios of trade

finance into a universally recognised investment tool the TFD initiative is

opening the flood gates for investors all around the world, all shapes and

sizes.

The two pillars that are driving the perceived benefits of

this scheme are the historical benefits experienced from a) increased global

trade and b) access to more funding which therefore drives point a.

The benefits of increased trade are no new aspect of world

economics. One of them being comparative advantage – a rather well acknowledged

benefit of international trade being more accessible.

Adam Smith wrote in 1776; “If a foreign country can supply

us with a commodity cheaper than we ourselves can make it, better buy it off

them with some part of the produce of our own industry, employed in a way in

which we have some advantage” (Book IV, Section ii, 12)

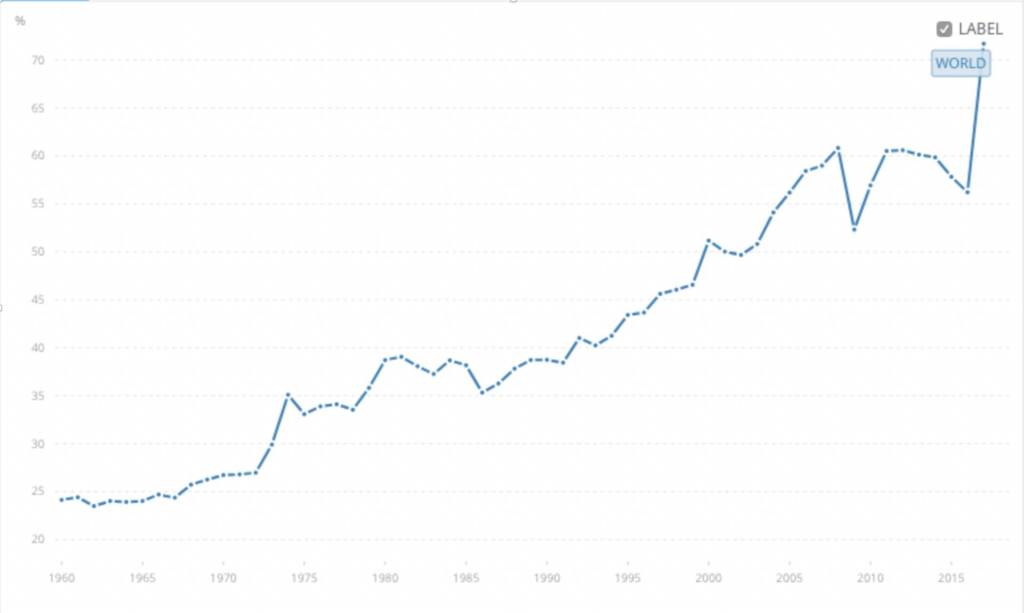

In 1960, global trade accounted for 24.13% of global

GDP. Today, it accounts for over 70%.

From this

graph, we see the Exports of Goods and Services as a percentage of GDP depicted

together as a global trend line. The range of the data is 1960-2017, showing a

strong positive trend line.

The major

dip in global exports and imports in 2008 was the financial crash. This is

understandable, the crisis affected trade immensely as countries production

suffered and incomes and wealth were hit hard.

However,

starting at 24.13% in 1960, and finishing at 71.7% in 2017, it shows a

considerably strong increase. In fact, it shows a 66.43% increase over the 57-year

period.

This then

calculates to an average of 1.157% increase in global trade as a % of GDP, each

year.

Similarities

The demand

for a standardized platform and packaging is something we are seeing in various

different sectors. Within the blockchain network R3 Marco Polo, we have the UTN

– Universal Trade Network which is aiming at producing an agreed standard way

of trading through all platforms of blockchain network.

Furthermore,

with the aforementioned Incoterms first introduced in 1936 by the ICC (International

Chamber of Commerce). Since then it cannot be denied that the

introduction of a set of standard rules and interpretations has improved and

advanced international commercial transactions. What’s more, these sets of

standard rules have altered throughout time, just as the parameters of trading

internationally have. And this is an important concept.

Just as trade has evolved over the years, alongside the

Incoterms which are regularly revised, the technology used in the large sector of

banking should be also.

By providing a regulated, standardised process for

investing, the financial backing upon which global companies can fund their

trade is increased massively.

Execution

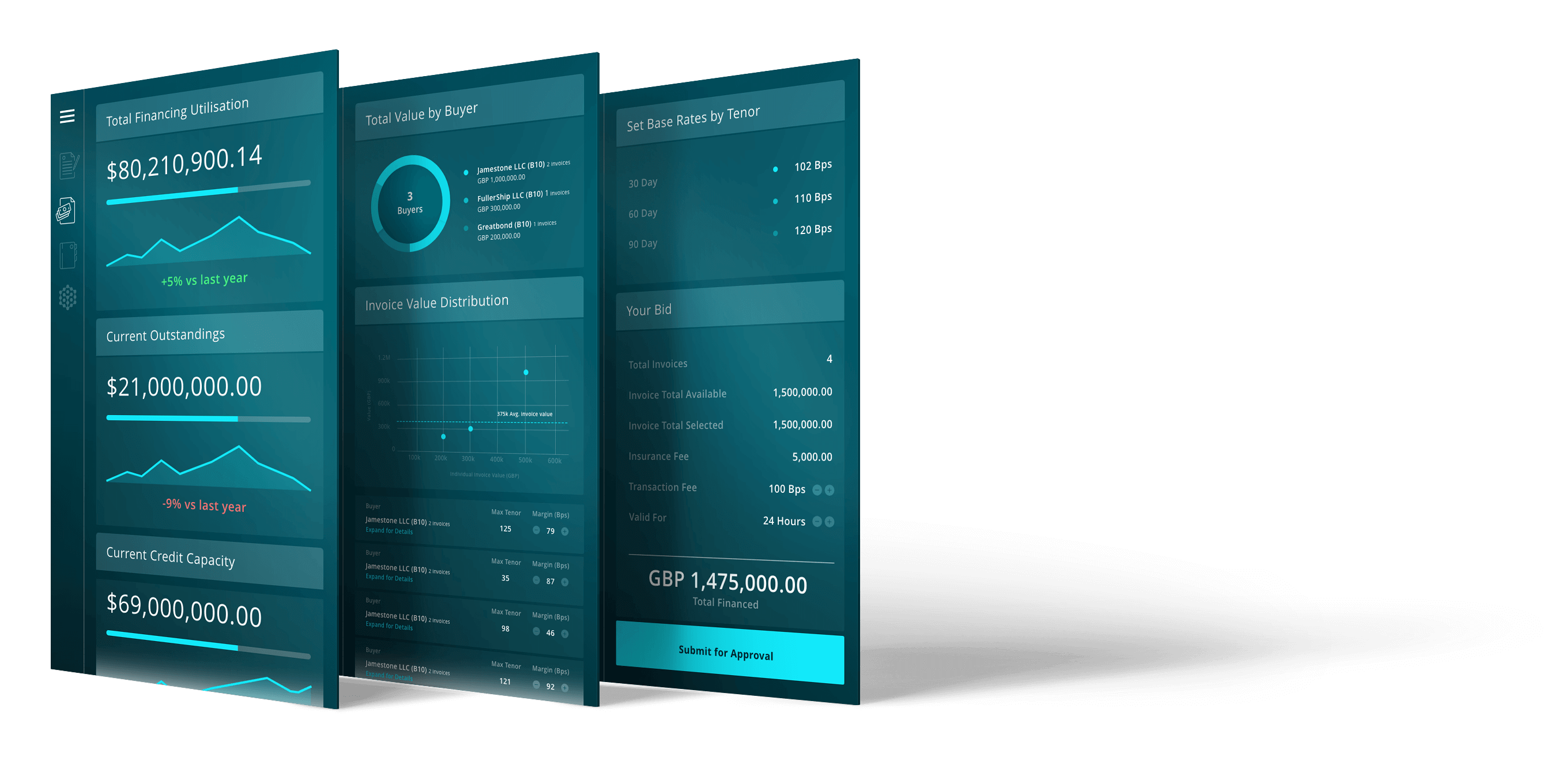

TFD initiative is introduced through Tradeteq, who “open

trade finance to the global capital markets, empowering banks to distribute

trade finance assets”. In late 2018, the company received £4.86 million to

further develop their investing platform. Reportedly, more than £150 million

worth of assets has been processed through the platform.

The £4.86 million was largely invested by ADV, a

tech-investing firm that prides itself on investing in companies for the long

term. Some of ADV’s previous investing recipients are Snap, Push Doctor and

BSecur. Some successful, industry leading ventures already.

Nils Behling, Founder and CFO of Tradeteq said “Trade

finance is the oldest banking product and the only one that couldn’t be

efficiently accessed by institutional investors”.

An impressive platform posed by some well-aged institutions,

backed by some credible observers is set to change the world of trade finance.

Way

back when… we used Balance sheets

Coming off the back of the 2008 financial crisis, we saw a

significantly large increase in banking regulations – rightly or wrongly implemented

in an attempt to discourage/ disallow the system that allowed such greed to

cause the crash in the first place.

What then came, was a move to the “originate-and-distribute

model”. This involves firms keeping much of their lending portfolio off of the

balance sheets in order to maintain their flexible working capital. This is of

course in contrast to “originate and hold” method, in which banks would create

the loans and hold them on their balance sheet until maturity.

The Originate-and-Distribute model allows banks to transfer

the loan after creation, which does not inflate the balance sheet but allows

growth for non-banking financial intermediaries.

How does this tie in? The technology posed by Tradeteq and

their team of supporters enable this to happen more efficiently and on a much

larger scale.

With this technology, Banks will continue to increase the

role that non-bank investors play in the trading of Trade finance assets, which

will completely transform the market. Chris Southworth, Secretary General for

the ICC said, “if we are going to bridge the $1.5 trillion trade finance gap,

we need to understand how banks and non-bank trade finance specialists can

combine to deliver the necessary finance to fund world growth”.

If we are going to bridge the $1.5 trillion trade finance gap, we need to understand how banks and non-bank trade finance specialists can combine to deliver the necessary finance to fund world growth

Chris Southworth, ICC UK