In fragmented markets, there is often a lack of real-time standardised data. In response, a group of eight leading financial institutions united on Chainlink’s platform, has launched an ambitious initiative to revolutionise corporate actions processing using artificial intelligence and blockchain technology.

The project includes Euroclear and Swift, as well as UBS, Franklin Templeton, Wellington Management, CACEIS, Vontobel, and Sygnum Bank. Together, the industry consortium targets inefficiencies in corporate action processing, which costs regional financial institutions $3-5 million annually.

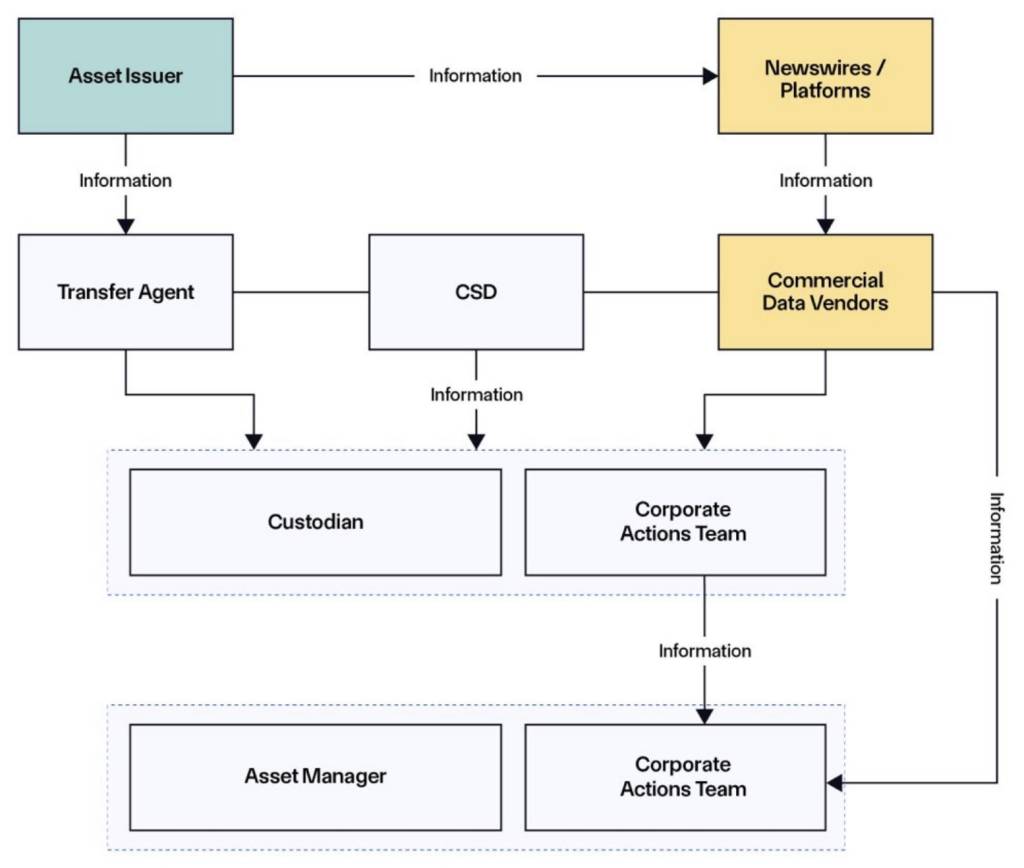

Generalised pipeline of how corporate actions data is distributed today. Source: Chainlink

According to industry research, around 70% of business units globally have incurred costs exceeding £1.6 million due to corporate action errors, with some paying as much as £34 million.

Corporate actions—which include anything from dividend payments to stock splits—have long been a source of inefficiency in financial markets. The current process relies heavily on manual validation of data from multiple sources, with 75% of firms revalidating custodian and exchange data manually, according to research by ValueExchange and ISSA.

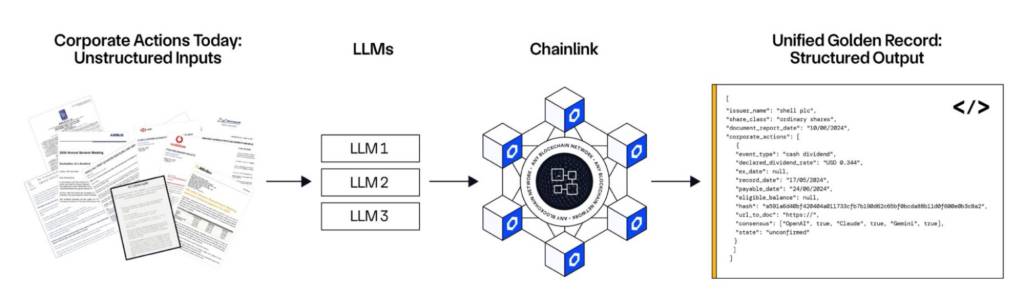

The consortium’s approach combines three large language models (LLMs) with Chainlink’s decentralised oracle networks to automatically extract and standardise unstructured data from corporate announcements. This information is then published across multiple blockchain networks, creating what the group calls a “unified golden record” accessible to all market participants.Early results from the initiative show promising outcomes. In testing across various European equity and fixed-income securities, the system achieved 100% consensus on fixed income events. However, the technology faced some challenges with equity events, where LLM outputs deviated in 7.2% of cases, particularly when processing complex documents such as lengthy earnings reports specifically around Vodafone’s dividend event.

How LLMs and Chainlink simplify the process. Source: Chainlink

“No one has a reliable golden source of data today—it’s all relative,” noted a participating executive from a ValueExchange survey.

The project’s first phase focused on mandatory corporate action events across six European countries, demonstrating the feasibility of converting unstructured data into standardised formats aligned with ISO standards and Securities Market Practice Group guidelines.

The consortium plans to integrate Swift messaging capabilities, allowing financial institutions to access the blockchain-based data through their existing systems; as well as to to expand the scope to include more complex corporate actions and additional data sources from exchanges and issuing agents.

With major institutions like Goldman Sachs and Bloomberg developing specialised tools, LLMs are increasingly making their mark in the financial sector for the promise they show in processing complex financial documents and extracting structured data. Yet, their “black box” nature and potential for hallucinations pose challenging. To address these concerns, institutions are also exploring ensemble learning and multi-LLM verification through Chainlink’s decentralised oracle networks (DONs).