The most recent version of the EU Federation (EUF’s) Industry Standard Whitepaper has been recently updated and published with the finalised market data for 2018.

The EUF decided to create a document that would effectively communicate the nature, purpose, size and shape of the Industry to interested stakeholders and why it should be treated with consideration to its specific nature. The EUF’s first unique Whitepaper on the Factoring and Receivables Finance Industry was published in 2016.

The FCF Industry supports and represents 11% of EU GDP, funding 240bn eur to around 220,000 businesses.

The document

proved to be a powerful tool and has been widely used and distributed as a

clear description and introduction to our business. So in 2018, the EUF ExCom decided

to update the paper and to seek to confirm the information and arguments still

hold true.

Roundwindow was kindly asked to repeat the programme and the exercise was carried out during the summer and autumn of 2018, using a mixture of live data obtained from a large scale Europe-wide survey, corporate financial data and finalised with EUF statistics for the year end 2018.

Low Loss Given Default (LGD)

The Whitepaper research shows that Factoring and Commercial Finance (FCF) continues to be a very low loss given default form of funding, and indeed that performance had improved even since the first iteration of the survey in 2016.

Other

findings in the research include that FCF:

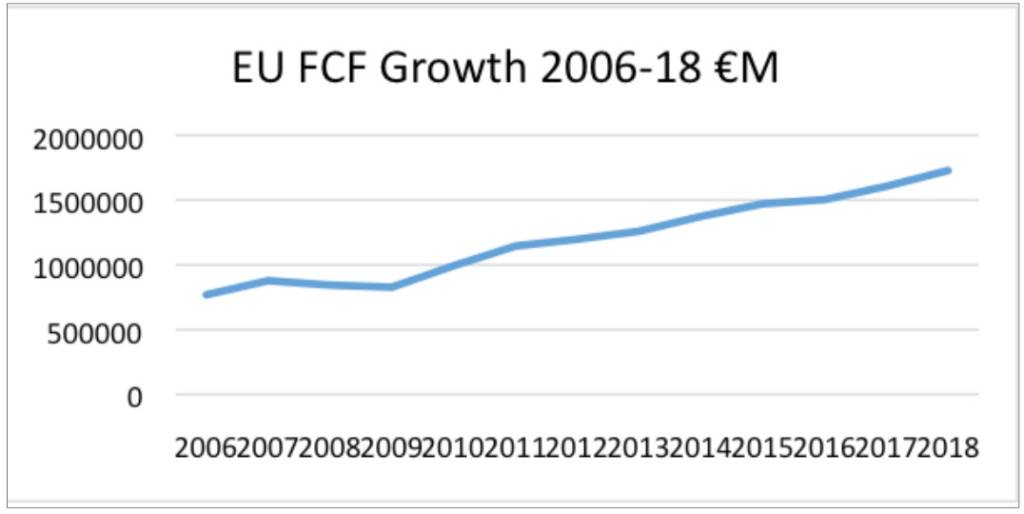

- has a demonstrable track record of growth with €1.7 Trillion client Turnover in 2018 – up 7.9% on 2017 and 7.4% CAGR over last 10 years,

- is funding on a scale that is material to EU GDP, demonstrating GDP Penetration of 11% across the EU 28, with €240 Billion advances on €310 Billion security, 220 Thousand clients and in the order of 200 scale providers across the Region.

In addition,

the study highlights:

- the three key areas of activity are manufacturing, services and distribution, representing around two thirds of numbers and three quarters of turnover and advances

- that the Industry continues to support all sizes of business, formSME to Large Corporate.

“The White Paper is a masterpiece in EUF communication. It demonstrates that the European Factoring and Commercial Finance is a real success story, with very low loss levels. From a regulator’s perspective this implies that this form of funding should be associated with a lower risk weighting and a lower cost of capital”

Mme Françoise Palle-Guillabert, Chairman of the EUF

What is Factoring and Commercial Finance?

FCF is a method of providing working capital to business which occupies a unique place in the world of finance. Let’s remind ourselves of the drivers that have led to this position.

The global crisis of 2008 precipitated a sustained period of overall lacklustre performance and weakened European economies; this, together with a further (though less severe) general slowdown in growth in the years 2012/3, resulted in many companies, particularly SMEs, experiencing greater difficulty in obtaining traditional bank funding than ever before. Banks became and have remained much less willing to lend into the SME sector.

FCF providers are instead generally experiencing increasing levels of new business enquiries and are continuing to write more new business than ever before.

The finance that FCF provides is principally secured by the underlying receivables. With a much reduced emphasis on the balance sheet, an FCF provider is able to offer significantly higher levels of finance to companies experiencing strong growth, that have a short track record or are requiring support through change and restructuring.

In seeking to define FCF, it has to be understood that the industry and its products are diverse

and varied; it is wide in scope and approach. There is no one single approach which is entirely

common across Europe. There are variations depending on market development, user needs and

significantly based on the varying legal and regulatory environments that pertain in the individual

countries where it is found.

Language and terminology can also be divergent, although the EUF has recognised this challenge

and has created a glossary of commonly used terms and a tool to translate these between five

major European languages. (See the EUF website: www.euf.eu.com/glossary-and-translator.html)

Accordingly, there is no one, simple universal definition; more realistically we have a family of

products and solutions with common features and approach.

This diversity is also a result of innovation and continuous improvement, adaptation to local

environment and adoption of latest technological advances.

But whilst acknowledging the variations, there are overriding common themes and attributes which

closely link the range together in a coherent and effective manner.

Based on the UNIDROIT Convention, FCF can be defined as:

An agreement between the assignor (the client using the services) and the FCF provider (offering

the services) in which the former assigns/sells its receivables (debtor sales invoices) to the FCF

provider, which delivers to the assignor a combination of one or more of the following services:

-

A Finance Function: payment in advance (depending on circumstances typically between 80%

and 90%) of the total sales invoices offered for FCF (credit facility function). The balance, less the

FCF provider’s charges, is usually paid when the invoice(s) is/are paid by the debtor. -

A Ledger Management Function: receivables collection and management including the gathering

of credit information about debtors, collecting debts, accounting, and the management of non-

performing advances. -

A Credit Protection Function: bad debt protection, i.e. the FCF providers’ assumption of the

responsibility for a debtor’s financial inability to pay.The relative levels of provision and utilisation of these various functions will be considered later in

the report. Broadly speaking, the most universally utilised and sought-after element in Europe at

least is the provision of finance.

About EUF

The EUF is the Representative Body for the Factoring

and Commercial Finance Industry in the EU. It comprises national and

international industry associations that are active in the region. Its members

represent 97% of the Industry turnover.

The EUF seeks to engage with Government and legislators to enhance the availability of finance to business, with a particular emphasis on the SME community. The EUF acts as a platform between the Factoring and Commercial Finance Industry and key legislative decision makers across Europe, bringing together national experts to speak with one voice. Data has been adjusted to ensure that currency exchange .