At Trade Finance Global we hear about pro-business policies and Trump putting America first; but what could this mean in relation to fundamental economics? We have looked at what has come out from the hedge fund industry and economists in the previous few months; especially Seth Klarman of Baupost Group. He has quite rightly outlined that the full ramifications of these pro-growth policies have not yet been considered in the markets.

Mr. Klarman explained that the stock market highs are actually viewed as perilously high valuations. Many investors have looked at what will flow from stimulative tax cuts and have not properly considered the possible risks of America-first protectionism along with new trade barriers.

What will Trump do?

The Trump presidency seems to have focused on slowing automation and the increasing globalization by using nationalistic rhetoric and asking companies to keep jobs at home. This will have a temporary slow down in market forces, but will lead to a negative outcome with uncompetitive and inefficient enterprises. These protectionist policies were something that the US stopped a long time ago, as they don’t work and lead to a poorer society.

There is a real fear gripping the economist community; relating to whether talk of pro-America and business growth policies will lead to actual expansion. Much of the stimulus policies and rhetoric could actually lead to greater inflation and poorer investment return. Set against this potential growth is the increasing debt burden of the US and the deficit will be impacted if the possible tax reductions are implemented.

Mr. Klarman looked at what happened when the US experienced the Bush tax cuts in 2001; it led to income inequality and large budget deficits. The possibility of an increase in interest rates would lead to an increase in the federal deficit, due to high interest payments on the large outstanding government debt.

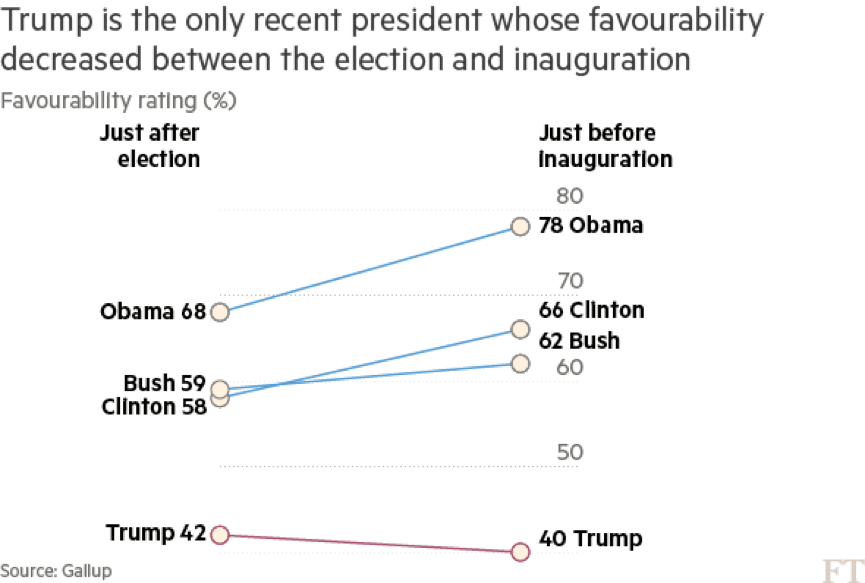

Christine Lagarde at the IMF has outlined the difficulties in the world economy that Trump protectionism could lead to. Fitch has also warned of Trump risks to the macroeconomic climate. This view is widely mirrored by many economists, who see overconfidence and erratic tendencies; with inconsistency of treatment in relation to foreign governments, population segments and industries. All is behind a vale of purported strong leadership. His early decision-making has been volatile at best, which has lead to a lack of clarity and fear of those in the business world.

Is the fear of Trump justified?

The risk according to Mr Karman is of a “decline in dollar hegemony, a rapid rise in interest rates… inflation, and global angst.” Many top investors have been afforded no certainty and the fear is that even those who usually can predict the future like George Soros have been found to be wrong; reportedly losing over $1 billion in recent months.