Part 1 of 3. Mounting concerns over Africa’s debt sustainability are frustrating key investment decisions and infrastructure financing. In this special 3 part report, Exx Africa identifies the countries in best and worst position to attract further debt.

Debt Sustainability – Where are we at?

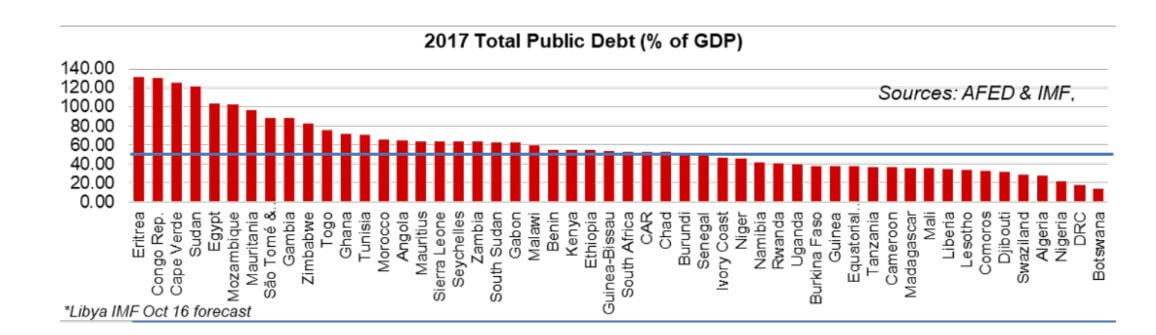

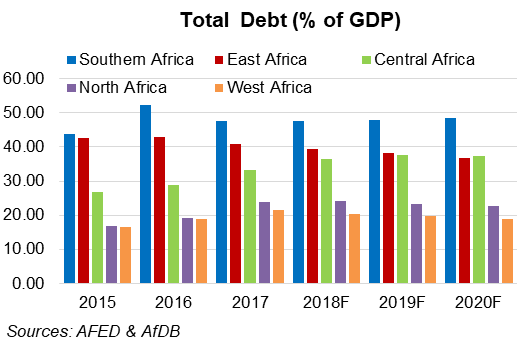

Since the 2008 global economic crisis, debt sustainability has deteriorated and risks of debt distress have sharply intensified. According to the latest October 2018 figures of the International Monetary Fund (IMF), public debt rose above 50.0% of GDP in 30 African countries of which 25 are sub-Saharan African countries. Africa’s economic recovery is in progress, but at a slower pace than expected. Global trade and industrial activity have lost momentum, as metals and agricultural prices have fallen due to concerns about trade tariffs and weakening demand prospects.

Drivers of Public Debt

While oil prices are expected to be on an upward trend into 2019, metals prices may remain unresponsive within muted demand, particularly in China. Financial market pressures have intensified in some emerging markets and concern about dollar-denominated debt has risen amid a stronger US dollar. Vulnerability to weaker currencies and rising interest rates associated with the changing composition of debt may put Africa’s public debt sustainability further at risk. The IMF has said that the share of foreign-currency-denominated public debt in total public debt increased across sub-Saharan Africa from an average of 23.0% in 2011–13 to 32.0% of GDP in 2017.

Total public sector debt has also risen in North African countries with Sudan and Egypt leading the way in 2017 at 121.6% of GDP and 103.0% of GDP, respectively. Mauritania’s total public debt reached almost 97.0%, followed by Tunisia with a figure estimated at over 70.0% of GDP in 2017. Mauritania’s government is committed to a prudent borrowing strategy, amongst others, to avoid non-concessional loans to ensure debt sustainability – this will back the downward trend in the expected debt figures for 2019 and 2020.

In September, Egypt’s Minister of Finance said that no new taxes will be imposed, clarifying that the new stage aims to stabilize fiscal policy. The Egyptian government’s aim for 2018/19 is to reduce its debt to 92.0% of GDP and is working on a structural reform program for the economy that aims at reducing public debt to 70.0% within four years, inflation rates to 14.0%, and unemployment to less than 10.0%.

Concessional versus non-concessional lending

The share of concessional financing in SSA has remained unchanged and official creditors continue to represent the largest creditor group, while the share of debt held by private banks and bondholders has increased to about 15.0%. At the same time, borrowing from non-Paris Club countries, especially from China, has been rising.

Non-concessional financing accounted for more than 50.0% of total public debt in six countries (Côte d’Ivoire, Ghana, the Republic of Congo, Sudan, Zambia, and Zimbabwe) and more than 30.0% of total public debt in several other countries (including Chad, Senegal, Mozambique, and Ethiopia).

Download Report Here