Estimated reading time: 0 minutes

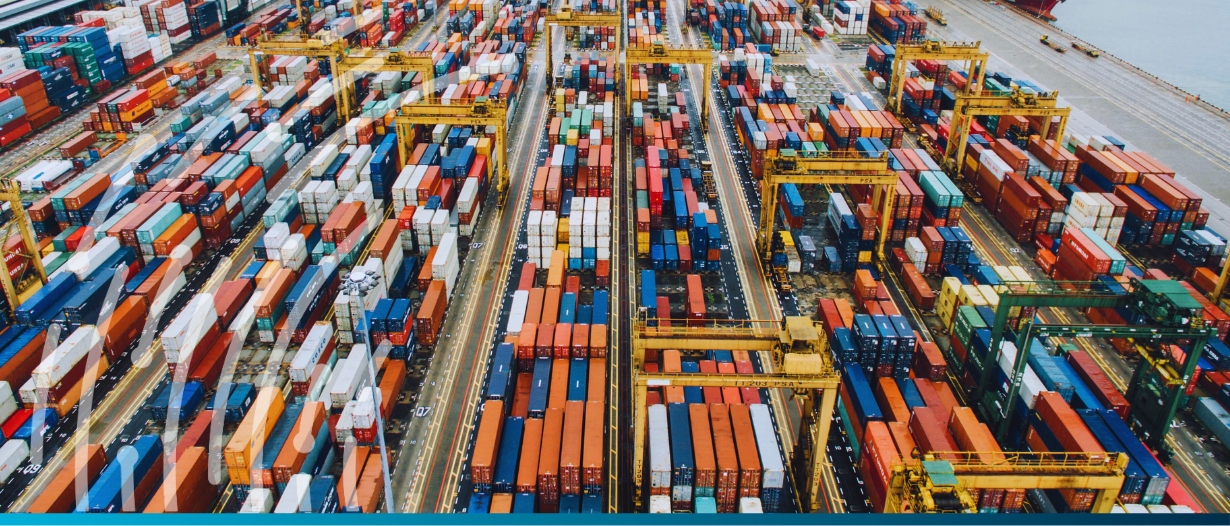

The global export credit industry has entered a new growth phase, with the Berne Union reporting $2.46 trillion in new commitments for the first half of 2024, despite mounting geopolitical tensions and economic uncertainties.

Also known as The International Union of Credit & Investment Insurers, Berne Union is an international non-profit association and community for the global export credit and investment insurance industry.

At their annual meeting in Hamburg last week, more than 300 participants from 89 institutions discussed collaboration in an increasingly complex trading environment.

It was reported that medium- and long-term export credit witnessed particularly strong performance, surging 22% to $73 billion. The growth was driven by significant infrastructure projects, including a 5G rollout in India and battery gigafactories in Germany and France. The transport sector remained dominant, bolstered by substantial cruise and cargo ship projects.

Short-term credit growth slowed to just 1%, marking a significant deceleration in the post-pandemic expansion, particularly in Europe and North America. Despite this slowdown, working capital and internationalisation products showed robust growth of 24% to $32 billion.

The industry faces mounting challenges from geopolitical risks, with political risk insurance claims rising sharply in the first half of 2024. Claims related to Russia saw a notable increase, triggered by expropriation, political violence and transfer events. Additionally, sovereign credit distress in Ghana, Zambia and Ethiopia contributed to elevated medium and long-term political claims of $2.2 billion.

Green transition remains a key focus, with $5.8 billion allocated to renewable energy projects. “International trade remains the backbone of our global economy,” said Maëlia Dufour, outgoing president of Bpifrance. “Even if it brings risks that are more complex to assess, it also brings tremendous opportunities.”

The Berne Union saw new membership applications from Brazil’s ABGF, the Brazilian Guarantees Agency, and MS Amlin, the London-based global insurer and reinsurer. It also announced a strategic collaboration with Finance in Common, the global network of all public development banks, to strengthen ties between export credit and development finance.

Despite total claims reaching $5 billion, the industry maintains a relatively stable position due to strong business growth. The Berne Union’s membership, comprising 85 institutions including government-backed export credit agencies and private insurers, now provides payment risk protection equivalent to approximately 14% of annual world trade.