PARIS, 12th June. Today marks the release of the ICC Banking Commission’s 2018 Trade Register Report – again highlighting the low-risk nature of trade finance in comparison to other asset classes.

ICC’s annual Trade Register Report is an authoritative source and benchmark for trade finance-related and export finance-related credit risk data for regulators, capital market participants and financial analysts.

This year’s report captures a full decade of trade finance-related data – containing over US$12 trillion of exposures and 24 million transactions across 25 banks, six products, and all major geographies – adding weight to its positioning as the global authoritative source on trade risk. The data also includes non-OECD Export Credit Agency-backed export finance and, given its growing and now longstanding significance across all markets, supply chain finance (specifically payables finance).

Key differences to previous report:

- Increased the scope of the Register to include payables finance, one of the major techniques of Supply Chain Finance (SCF), to reflect the shift in trade financing from documentary trade towards open account terms

- Increased the scope of the Register to include non-OECD ECAs for export finance products, to reflect increasing importance of non-OECD Arrangement ECAs

- Improved the data collection methodology to include validation at point of data entry, improving the usability and integrity of underlying data set.

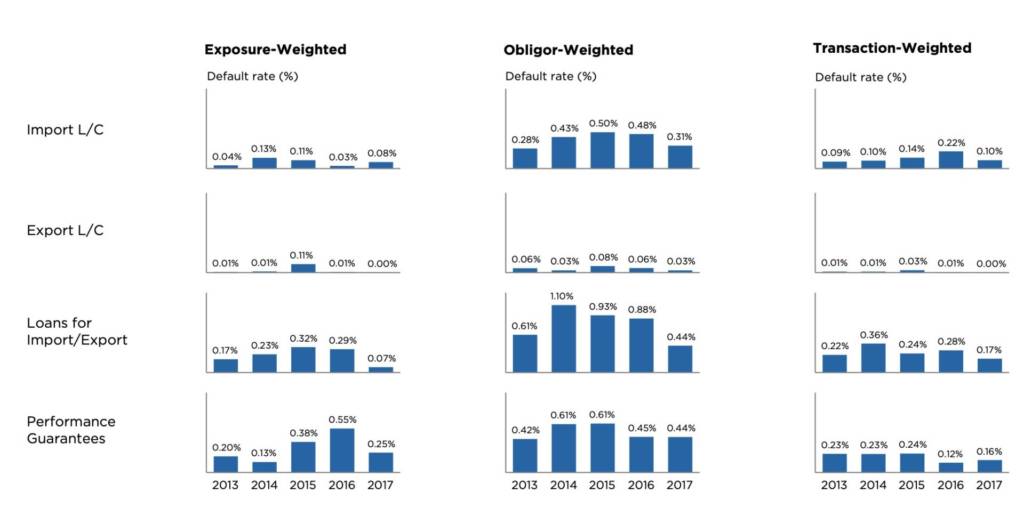

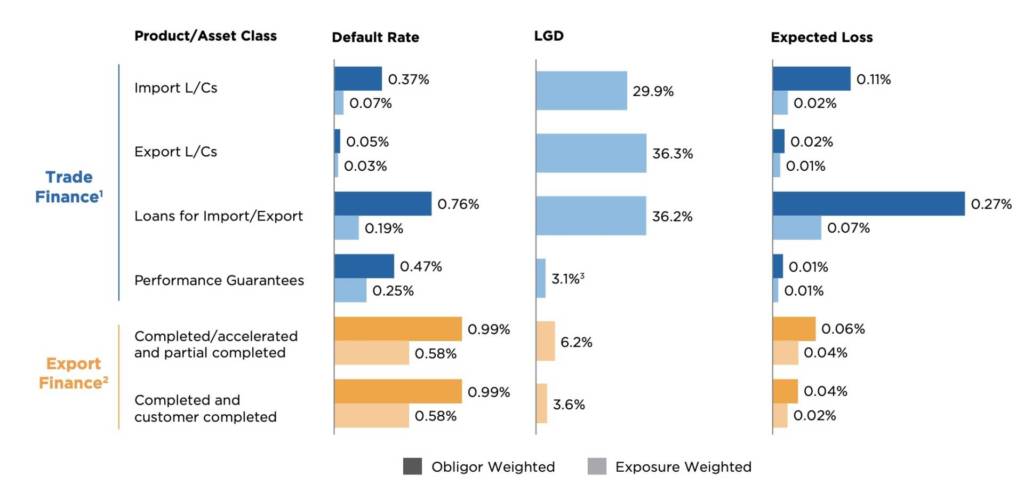

In turn, results indicate that default rates from 2008-2018 are low across all products and regions, averaging 0.37% for Import Letters of Credit (L/Cs), 0.05% for Export L/Cs, 0.76% for Loans for Import/Export, and 0.47% for Performance Guarantees (when weighted by obligors). The results extend the decline in risk seen in 2016 into 2017, likely driven by strong GDP growth and the general de-risking approach taken by banks with regards to their balance sheets.

Trade Register Report 2018

As in previous years, the report was conducted with the support from both Global Credit Data (GCD) and Boston Consulting Group (BCG). BCG, for its part, contributed a strategic perspective to the paper, including insights from their 2019 Trade Finance Model. Meanwhile, ICC worked alongside GCD to advance the Trade Register’s scope and methodology. Leveraging GCD’s experience, the project now uses automatic data validation at point-of-entry – adding to the reliability of data and simplifying the data collection process for member banks.

This year’s data set also includes non-OECD Export Credit Agency-backed export finance and, given its growing and now longstanding significance across all markets, supply chain finance (SCF).

In its inaugural year, the SCF data set, while relatively small, provides initial indications that the probability of default for SCF is similar to other short-term trade finance products. “This year’s report reinforces the findings of previous years’ studies: trade finance products present banks with low levels of credit risk,” says Daniel Schmand, Chair of the ICC Banking Commission. “This further supports the favourable treatment of trade finance as an asset class by the Basel Accords and increases the attractiveness of trade finance to banks, benefiting global trade and widening market access.”

Going forward, the ICC Trade Register will continue to build bank participation, data quality, product scope and the types of risk examined, to best serve the trade finance community, and – importantly – its member banks who invest significant time and resources to support the project.